Online banking directly in Salesforce: Here's how it works with millio

Online banking directly in Salesforce: Here's how it works with millio.

Companies want to handle their payment processes directly in Salesforce without having to switch between banking portals, accounting software, and CRM. Online banking from Salesforce allows you to securely execute payments, view account balances, and monitor transactions, all in one central location.

Many companies struggle with time-consuming manual processes, lack of transparency, and error-prone Excel spreadsheets. The direct integration of online banking into Salesforce creates efficiency, automation, and clarity.

Why is online banking from Salesforce important?

- Centralized management: Bank accounts, payments, and bookings in one place.

- Time savings: No separate login to bank portals or manual data transfers.

- Error reduction: Automatic processing reduces transposed digits and incorrect allocations.

- Real-time transparency: Account balances and transactions can be viewed immediately.

- Compliance & security: Encrypted interfaces.

How online banking works in Salesforce

1. Set up bank integration: Select Millio in App Exchange to begin the integration process.

2. Connect bank accounts: Securely connect your bank account to the Millio app in Salesforce.

3. Authentication: Authorize encrypted bank access without disclosing sensitive data.

4. Retrieve transactions: Account balances, payments, and postings are automatically synchronized.

5. Execute payments: Initiate transfers, standing orders, or direct debits directly from Salesforce.

6. Automatic payment allocation: Payments are automatically allocated to invoices or projects.

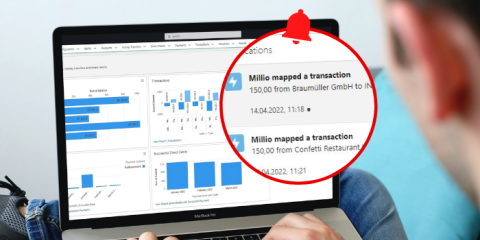

7. Dashboards & notifications: Set up alerts for failed payments or unusual activity.

Tip: Test the setup with small amounts first to avoid errors. 💡

Benefits of online banking from Salesforce

- Real-time account transparency: Every payment and receipt is immediately visible.

- Automation: Payments, invoices, and bookings are processed without manual effort.

- Error prevention: Automatic allocation reduces incorrect bookings.

- Cash flow optimization: Better liquidity planning thanks to up-to-date data.

- Integration with reporting: Financial data flows directly into dashboards and KPI analyses.

Tools and features for online banking in Salesforce

- Multibanking: Manage multiple accounts centrally in Salesforce.

- Automatic payment allocation: Payments are automatically allocated to invoices or projects.

- Templates & workflows: Automate recurring payments.

- Dashboards & reporting: Overview of account balances, open items, and cash flow.

- Alerts & notifications: Warnings for failed payments or chargebacks.

Conclusion

Online banking from Salesforce enables centralized, automated, and secure payment processes. Companies save time, reduce errors, and maintain an overview of account balances, payments, and open items at all times. This allows financial decisions to be made more quickly and with greater confidence.

FAQ – Online banking in Salesforce 🔍

- Can I manage multiple accounts at the same time? Yes, multibanking allows you to manage multiple bank accounts centrally.

- How often are transactions updated? In real time or at individually defined intervals.

- Can I automatically assign payments to invoices? Yes, modern apps check the invoice number, amount, and purpose.

- Is online banking from Salesforce GoBD-compliant? Yes, all transactions and postings can be documented in an audit-proof manner.

- Can I set up standing orders and recurring payments? Yes, many apps allow you to automate recurring payments directly from Salesforce.

- Are notifications sent in the event of unusual activity? Yes, alerts for failed payments or chargebacks can be set up.

Your onlinebanking in Salesforce

Convince yourself of millio in a free demo without obligation. Book your demo now!

Book a demo