How millio optimises your business online banking

How millio optimises your business online banking

When it comes to process optimisation and digitalisation with Salesforce in companies, the processes in bookkeeping and accounting are rarely considered. Yet there is also a lot of optimisation potential here to save time and thus costs.

#1 Save time thanks to the integration of all processes in one system

millio allows you to bundle all your different bank accounts in a single interface. This means you can access all your bank accounts directly in your Salesforce environment and view your account balances and transactions at any time with just one click.

This overview is not only particularly practical, it also saves an enormous amount of time. Because with millio you can see your account movements without having to log into your various online banking platforms several times a day. Being able to manage everything in one place makes your banking much easier and optimises your time management.

#2 Increase your efficiency thanks to automated reconciliation of incoming payments and invoices

Whether and when your customers have paid their outstanding invoices is one of the most relevant pieces of information for your business. With millio you can see all incoming and outgoing transactions in your account overview at a glance.

But it gets even better: To save you the manual reconciliation of invoices, customer data and incoming payments, it is also possible to fully automate this process with the Salesforce Banking App.

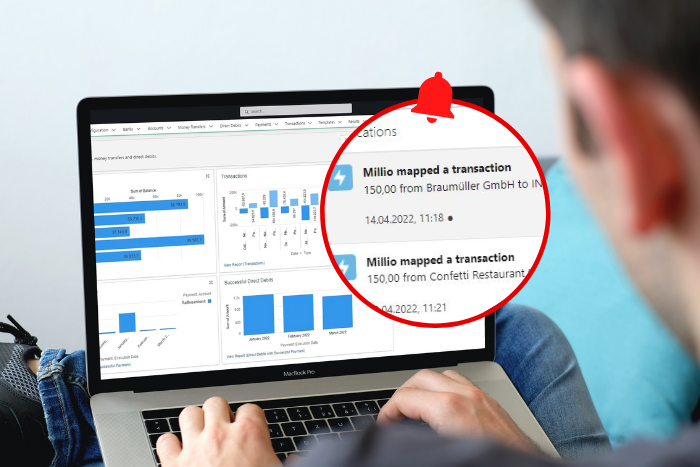

millio automatically matches fields of the incoming payments and the customer invoices stored in Salesforce in the background. If millio finds a match here, you receive a notification and know immediately which customers have paid their invoices.

Sounds practical? It is!

X

X

#3 Manage your payment orders more efficiently and quickly

millio also saves you a lot of time and manual effort in your outgoing payment transactions.

Instead of filling out transfer masks over and over again, you can easily prepare templates for recurring transfers with millio and use them for the next payment order. You can also transmit standing orders to the bank with millio.

Another plus: You can create transfers from your CRM accounts with one click. The transfer mask is then already pre-filled with all important data and thus minimises sources of error.

#4 Prepare your key figure reporting at the push of a button

Setting up (monthly) reporting should also take a lot of time in your company. Collecting figures from different platforms and bringing them together in a clearly understandable overview: that takes time.

With millio, on the other hand, you can complete this task at the touch of a button and in just a few seconds. This is another advantage of the Salesforce integration: millio uses the powerful reporting tools of Salesforce and prepares your most important financial figures graphically and in a way that is easy for everyone to understand.

millio saves you a lot of time and gives your company and your team a long-term competitive advantage. The time you save with millio can be spent in the future on value-adding tasks and projects that move you and your company forward.

Your onlinebanking in Salesforce

Convince yourself of millio in a free demo without obligation. Book your demo now!

Book a demo