millio@work: Real estate industry

In the real estate industry, there are a multitude of highly complex tasks to manage in the finance area: Large sums of money regularly change accounts, transactions must be monitored and numerous service providers must be paid, while at the same time contractual payment deadlines must be met. A single mistake can have serious consequences.

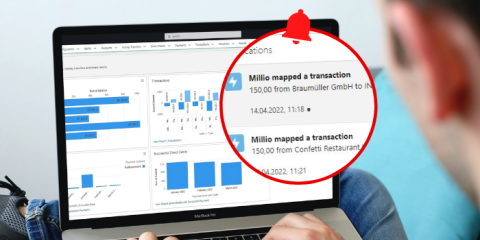

It is not easy to keep track of everything. But the Salesforce CRM system can be an enormous help here. Through the integration of tools like millio, the flexible system can manage much more than just customer data.

Tasks in finance and controlling departments in the real estate industry

The real estate industry is a broad field and encompasses many different areas. Nevertheless, in the finance and controlling departments of real estate managers, in construction project management and in building maintenance and development, there are similar tasks that come up again and again.

These include, for example:

- Accounting: Accounting fundamentally involves the management of financial transactions and the maintenance of financial records. It also includes managing accounts and preparing financial reports.

- Budget planning and management: Companies in the real estate industry need to prepare and manage budgets for the purchase, development and management of real estate. This includes monitoring and controlling costs.

- Rental management: It is common in the real estate industry to rent out properties. Companies need to ensure that rents are collected on time and that tenant accounts are properly managed. This includes drafting leases and managing security deposits.

- Tax matters: Companies in the real estate industry must ensure that they comply with all tax regulations. This includes preparing tax returns and paying taxes.

- Management of operating costs: Companies in the real estate industry need to manage the operating costs for their properties. This includes monitoring electricity and water consumption and managing insurance premiums.

- Managing properties: Companies in the real estate industry need to ensure that they have all the necessary permits and licences to own and manage properties. This includes the management of property portfolios and the financial valuation of properties.

X

X

These problems cost you efficiency and accuracy of your financial data

With the same tasks due to similar high complexity of processes, key figures and projects, a multitude of problems occur again and again, which can affect the efficiency and accuracy of financial data in the company.

Some of the most common problems in this industry include:

- Insufficient data quality: A common problem in the real estate industry is the insufficient quality of the financial data stored in the systems. This can be due to poor data entry or insufficient system integration.

- Lack of automation: Many companies in the real estate industry still rely on manual processes to collect and process financial data. This can lead to data being lost or errors occurring when employees have to perform tasks manually.

- Complexity of data: The real estate industry is very complex, and financial data can include many factors that further complicate data interpretation.

- Difficulty in complying with regulations: Companies in the real estate industry often have to comply with numerous regulations, which can lead to difficulties in managing financial data and meeting compliance requirements.

- Lack of integration: A large proportion of companies in the real estate industry use separate systems to manage financial and accounting data, making integration and oversight difficult. This can lead to employees struggling to get a complete picture of financial data, which in turn makes decision-making massively more difficult and can lead to more bad decisions.

- Difficulty in budgeting and forecasting: Forecasting income and expenditure in the real estate industry can be difficult as it is heavily influenced by external factors such as interest rates, market growth and economic and political conditions.

millio provides you with these 5 solutions

An online banking integration like millio can help solve some of the above issues directly.

- Improved data quality: The integration of online banking into the CRM system automates payment reconciliation and thus ensures higher data quality, as the data is automatically checked for correctness. For example, there is no matching of transaction and invoice as soon as information such as amount or reference differ.

- Automation of manual processes: millio completely automates the process of payment reconciliation, which minimises manual processes and thus enormously reduces sources of error. The payment of invoices or the collection of direct debits can also be automated in millio in a time-saving manner.

- Better data integration: millio makes it possible to seamlessly integrate financial and account data into Salesforce so that employees have a complete picture of financial data.

- Improved compliance: millio can help you meet compliance requirements by providing a secure and transparent system for processing financial data. By assigning rights in Salesforce, it is also possible to precisely define who in the company has access to account data and who does not.

- Better budgeting and forecasting: millio can also help improve revenue and expense forecasting by providing real-time data of your bank accounts and streamlining planning processes.

Conclusion

By using millio as an online banking integration in Salesforce, your company can make finance and controlling departments more efficient, improving the accuracy of financial data. millio offers seamless integration of German and Austrian bank accounts in Salesforce, making it easier for your teams to manage financial data, work more error-free, meet compliance requirements and improve budgeting and forecasting.

Your onlinebanking in Salesforce

Convince yourself of millio in a free demo without obligation. Book your demo now!

Book a demo