millio@work: Non-profit organisations

As a founder or staff member of a non-profit organisation, you have a very special role to play in supporting and achieving your mission for the benefit of society.To best fulfil your mission, you need not only donations, but also appropriate fundraising management. But we know that it is often difficult for NGOs to allocate the necessary resources for an effective finance department.

In this context, the integration of online banking in Salesforce can be enormously helpful for you as a non-profit organisation and relieve you of a lot of manual effort.

These tasks will certainly sound familiar to you

As an employee in the finance department of an NGO, you have many tasks that you have to manage. These include:

- Management of donations and grants: NGOs need to collect, record and manage donations and grants to ensure that these funds are used in accordance with donor requirements.

- Budgeting and financial planning: NGO finance departments must prepare budgets and develop financial plans to ensure that the organisation can achieve its goals.

- Accounting and reporting: NGOs must accurately record their financial transactions and prepare reports to monitor their financial position and ensure that they comply with legal and tax requirements.

- Payment processing and invoicing: NGOs need to make payments to suppliers and service providers and pay invoices from partners and suppliers.

- Tax returns and compliance: NGOs need to ensure that they file their tax returns on time and correctly and meet all legal and regulatory requirements.

These tasks are often very time-consuming, complex and require manual intervention and checks.

These are the challenges many NGOs face when it comes to finance

But we also know from our project experience that there are many challenges that limit you and your team in effectively completing your tasks.

- Lack of resources: NGOs often have limited resources and budgets, which makes it difficult to invest money and time in tools and to automate or improve the necessary financial processes.

- Complexity of financial processes: Financial processes in NGOs can be very complex, especially when it comes to managing donations and grants and reporting.

- Error-proneness: Manual data entry and handling of paper documents can lead to human errors, which in turn result in incorrect reports and irregularities.

- Lack of transparency and traceability: NGOs need to ensure that their financial processes are transparent and traceable so that they can justify the use of donations and grants. However, manual processes and paper documents can lead to confusing and unclear financial reporting. It is also often difficult to attribute recurring donations to individuals.

- Compliance and regulatory requirements: NGOs often have to meet a variety of compliance and regulatory requirements that change frequently and can have an impact on financial processes.

And let's be honest: you have much more important tasks to do than to spend time manually allocating donations and going through transactions.

X

X

The solution for your donation management is called millio

Here are some ways millio can help you solve your finance problems:

- Automation of financial processes: millio can help to greatly reduce manual intervention and paper-based processes and increase the efficiency of your financial processes, for example by automating the collection of direct debits if regular donors wish to do so.

- Integration of bank accounts and transaction data: millio can integrate your German and Austrian bank accounts into the Salesforce environment in order to integrate transaction data and process it accordingly in Salesforce.

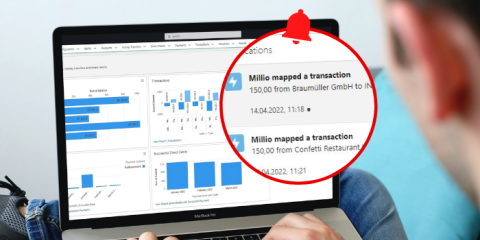

- Real-time transaction monitoring: millio monitors your transactions in real time. This allows you to see directly when new donations have been received on the accounts.

- Compliance and regulatory compliance: millio can help to meet compliance and regulatory requirements and make reporting transparent and traceable.

- Financial reporting and analysis: millio can help you with financial reporting and analysis, improving the efficiency of the finance department by reducing the amount of time you spend searching for data.

Conclusion

Investing in an online banking tool for Salesforce can provide you and your foundation with significant advantages in your daily charitable work and simplify your donation management. Automations not only save you a lot of time that you and your team can better invest elsewhere, they also give you a better overview of your current financial situation.

PS: We have special pricing for non-profit organisations at millio! Contact us directly.

Your onlinebanking in Salesforce

Convince yourself of millio in a free demo without obligation. Book your demo now!

Book a demo