SaaS: How we at millio work with millio

🥁 Attention please, today we’re giving you a behind-the-scenes look and showing you how we ourselves have integrated millio into our Salesforce processes.

Because, as the saying goes, “Drink your own champagne.” And since we ourselves have no desire for manual payment reconciliation and endless clicking in the bank’s online banking portal, we naturally use millio in our Salesforce system.

(Short disclaimer: In the videos, we explain our processes using a Salesforce demo environment. 😉 But you’ll still get a good impression of our procedures. So let’s go!)

💲 We create our transfers and direct debits in millio.

To pay our incoming invoices, we don’t first log into our bank’s online banking portal to organize orders there.

Because we create payment orders, such as transfers or direct debits, entirely in millio. Without leaving our Salesforce CRM. This saves us a tremendous amount of time.

In addition, transfer records can be filled out directly by the employee who placed an order and received the corresponding invoice. This transfer record is then converted into a payment record and sent to the person responsible for finances (in our case, the boss) for approval. They then only have to send the payment record to the bank with a click.

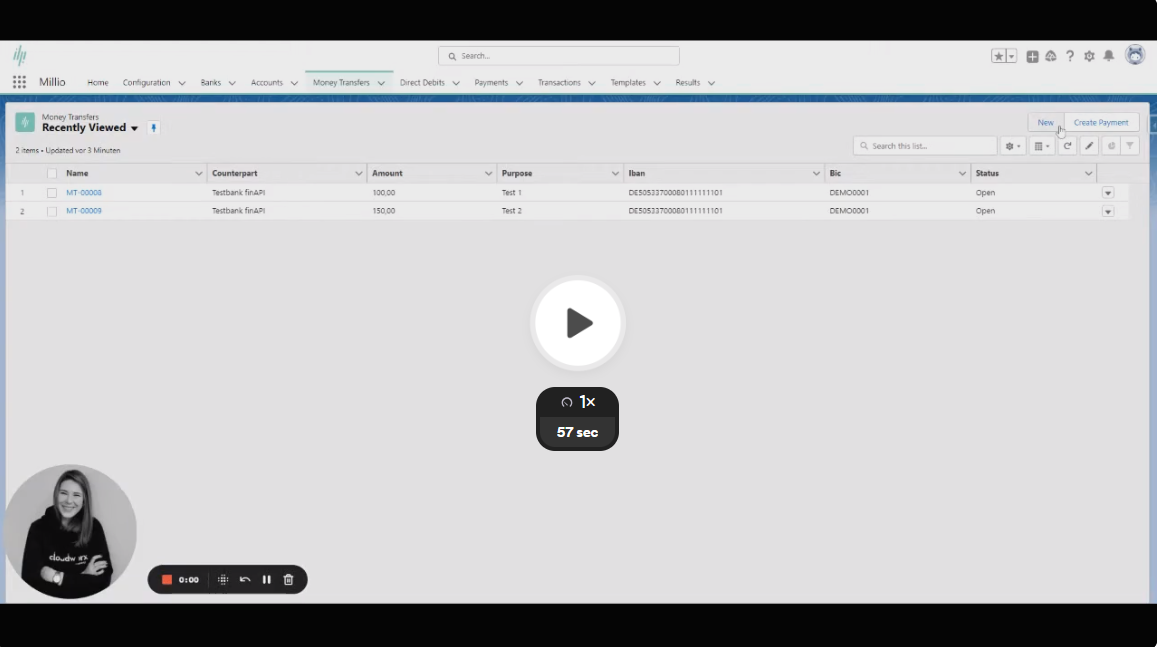

In the video, you can see how quickly and easily a transfer is created in millio 👇

X

X

🎓 And this is how it works: First, we create a new money transfer as a transfer record. We fill this with all relevant information, such as recipient, IBAN, and BIC, and create the record.

The “Create Payment” button then creates a payment record (essentially a transmission record) that must be sent to the bank.

This step allows for another review of all payment orders which—either directly or all together in a payment run—are transmitted to the bank and executed.

We also collect the license fees for our solution directly via millio using the direct debit procedure (Direct Debit).

For this, our users give us a SEPA direct debit mandate when booking licenses. This is an enormous time-saver, especially for companies with numerous constantly recurring payments!

💲 We keep an eye on bank accounts, transactions, and key figures.

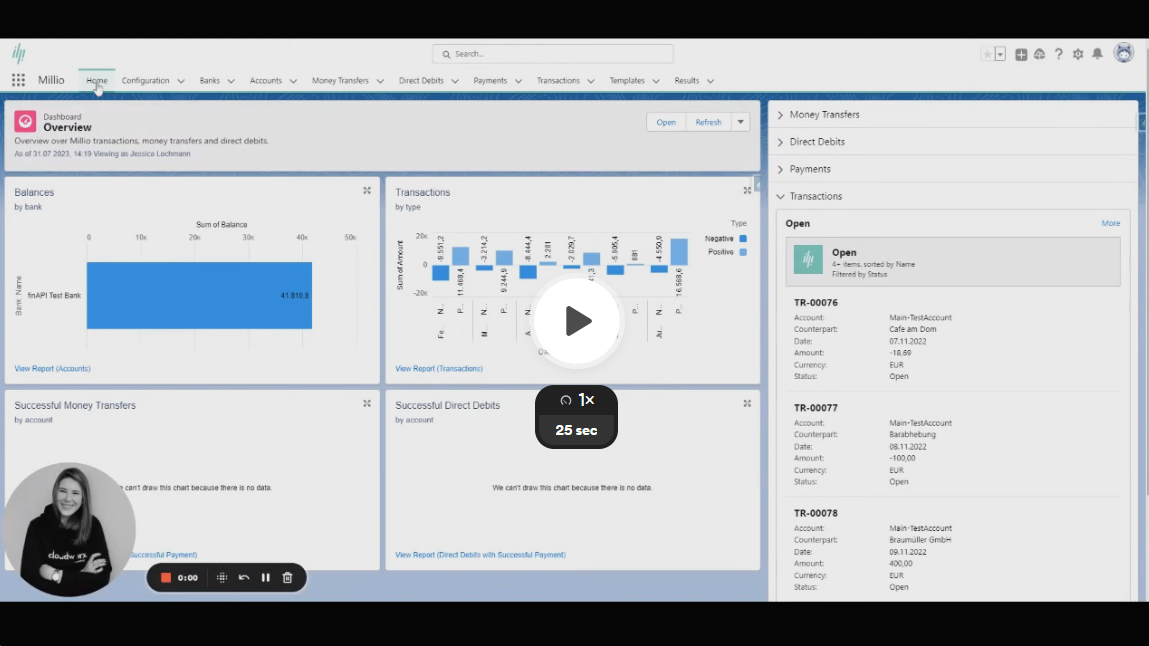

Thanks to millio, we always have access to the most up-to-date financial data directly in our Salesforce system.

On the home screen or in the dashboards, we can see directly the current balances of all bank accounts, how many transfers and direct debits were successfully executed, and which amounts have come in and gone out.

X

X

You can, of course, customize the dashboards according to your requirements so that you see the evaluations that are relevant for you and your company.

One more practical note: In addition to bank accounts, you can connect other payment service providers such as Qonto or PayPal and also display these balances!

💲 We automate our payment reconciliation with millio.

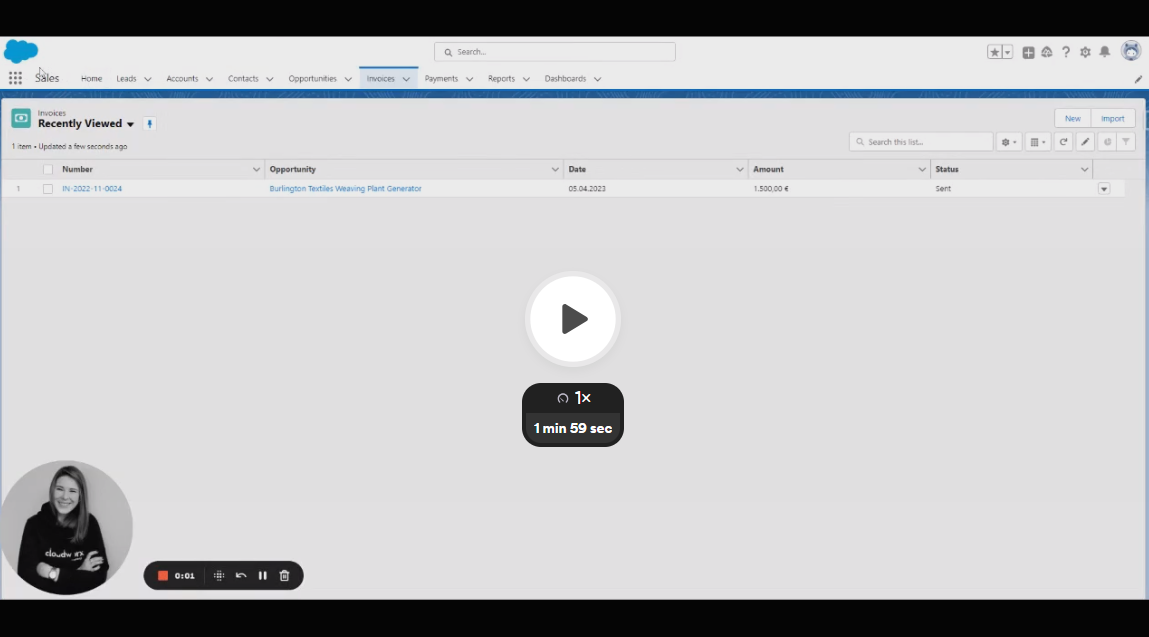

As a company, we—just like you—depend on customers paying their invoices.

But the search for the matching transaction to the right invoice… and that on different bank accounts… that can be pretty tedious, right?

We knew the problem. But with millio, that’s a thing of the past. At least for the most part.

Because millio takes care of assigning invoices and transactions for us directly in Salesforce.

If a suitable assignment has taken place based on the invoice number, the amount, and other information, we receive a notification and know that the customer’s payment has been received in the bank account.

In the video, you can follow what the future of your payment reconciliation in Salesforce looks like 👇

X

X

🎓 This is how it works: In the configuration record, you can basically train millio and provide the tool with which information it should match in the transaction and invoice record.

If a transaction enters the system that meets the sought criteria, millio carries out the assignment automatically* and correctly, informs us of the assignment via the notification symbol, and automatically creates a payment record. This record links the invoice and the transaction.

(*In the video, we helped manually by clicking the “Map” button. Normally, the assignment takes place automatically at a certain time interval, but we didn’t want to wait that long at this point 😉)

But wait… what about transactions that cannot be assigned, for example due to a transposed number or an incorrect amount?

These unassigned transactions remain with the status “Open” in your transaction list. The person responsible in accounting then only has to go through this list and find the corresponding error.

A transposed number, for example, can be quickly corrected and the assignment can be made by clicking the “Map” button.

If, on the other hand, an amount was transferred in installments with the same invoice number by the customer, you also have the option in millio to allow “Multiple Hits,” i.e., multiple assignments.

Pretty practical, huh?

If in the future you also no longer feel like manual payment reconciliation and would rather organize everything in your Salesforce interface—and do so absolutely securely and efficiently—then 👉 get in touch with us directly.

Would you like to browse more success stories? Then click here.

Your onlinebanking in Salesforce

Convince yourself of millio in a free demo without obligation. Book your demo now!

Book a demo